Resources

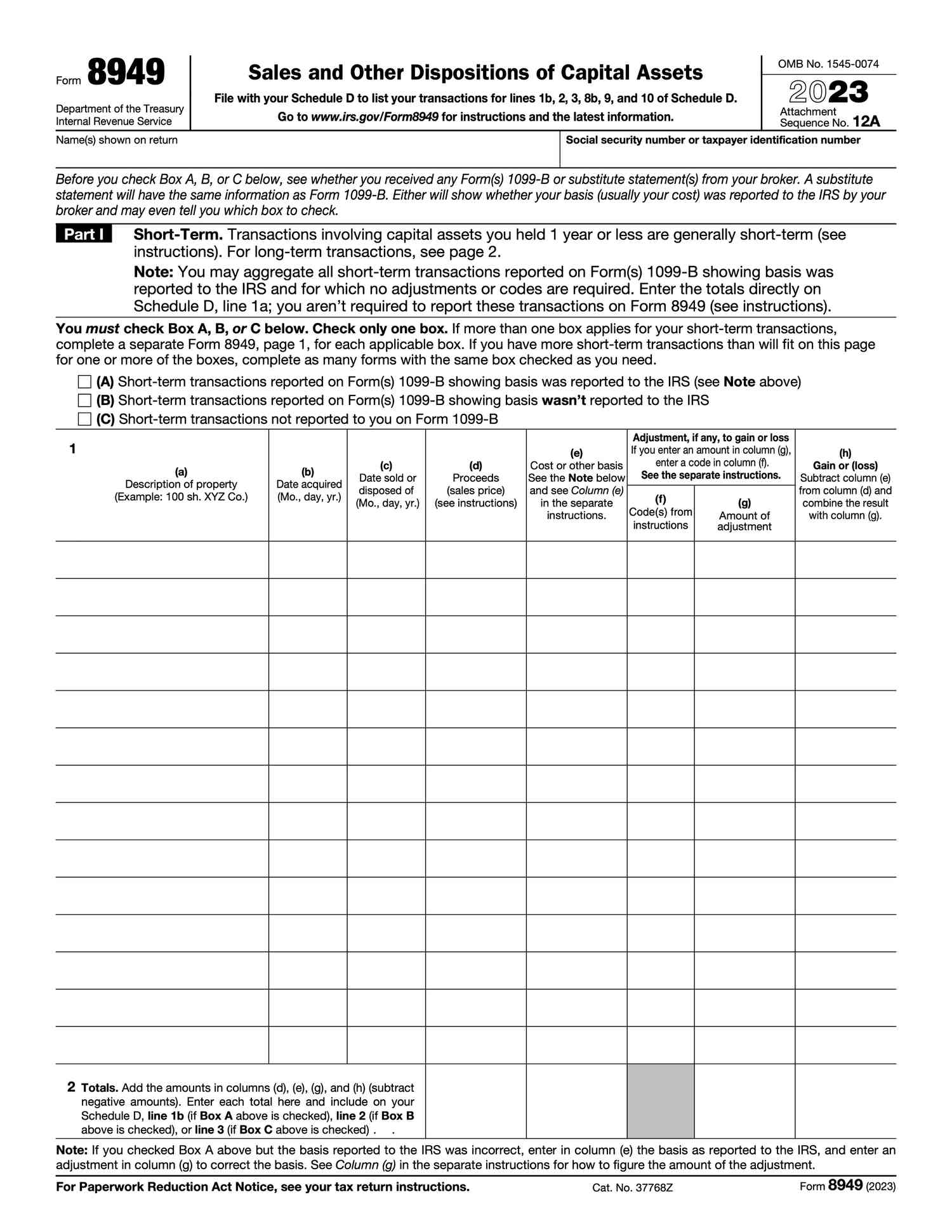

Form 8949

Sales and Other Dispositions of Capital Assets

Use Form 8949 to reconcile amounts that were reported to you and the IRS on Form 1099-B or 1099-S (or substitute statement) with the amounts…

Available in:

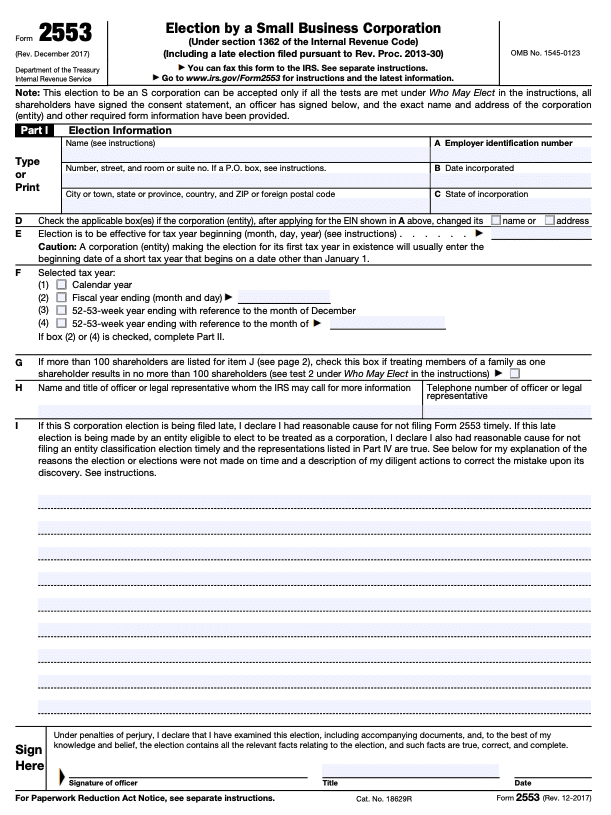

Form 2553

Election by a Small Business Corporation

Form 2553 is used by qualifying small business corporations and limited liability companies to make the election prescribed by Sec. 1362.

Available in:

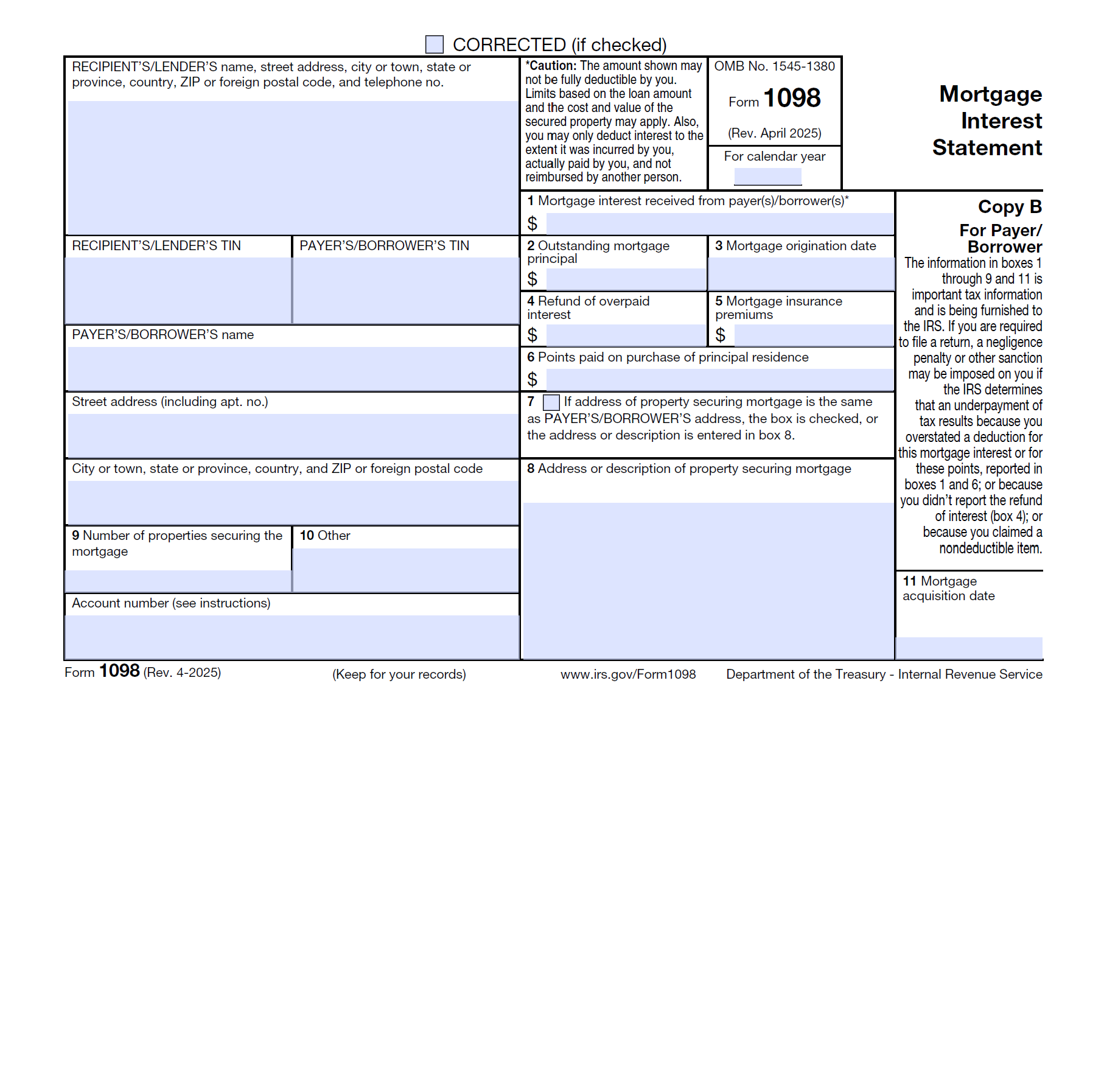

Form 1098

Mortgage Interest Statement

If you hold a mortgage credit certificate and can claim the mortgage interest credit, see Form 8396. If the interest was paid on a mortgage, home equity loan, or line of credit secured by a qualified residence, you can only deduct the interest paid on acquisition indebtedness, and you may be subject to a deduction limitation.

Available in:

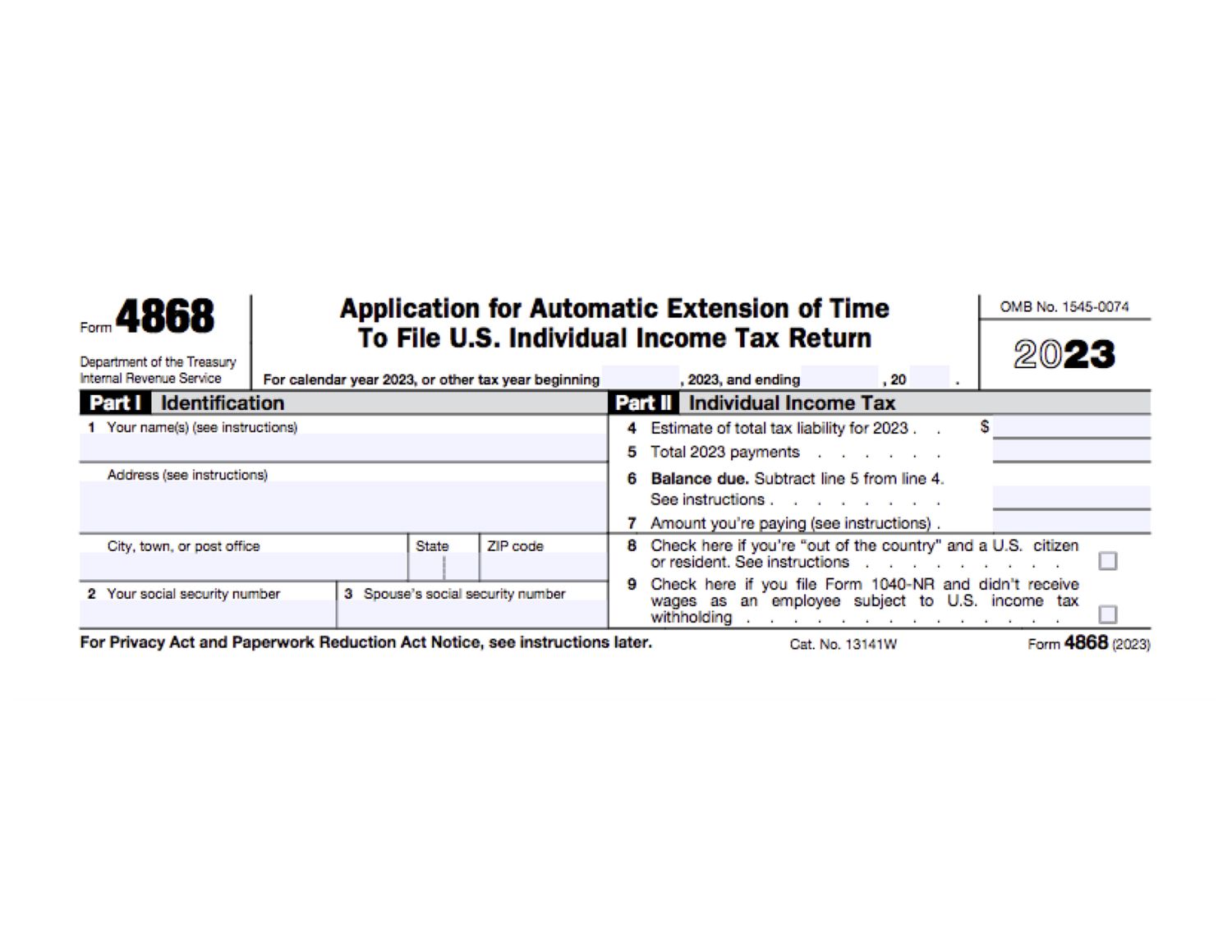

Form 4868

Application for Automatic Extension of Time to File U.S. Individual Income Tax Return

If you can’t complete your federal tax return by the deadline, find out how and when to file an IRS extension and push your deadline back to October 15th.

Available in:

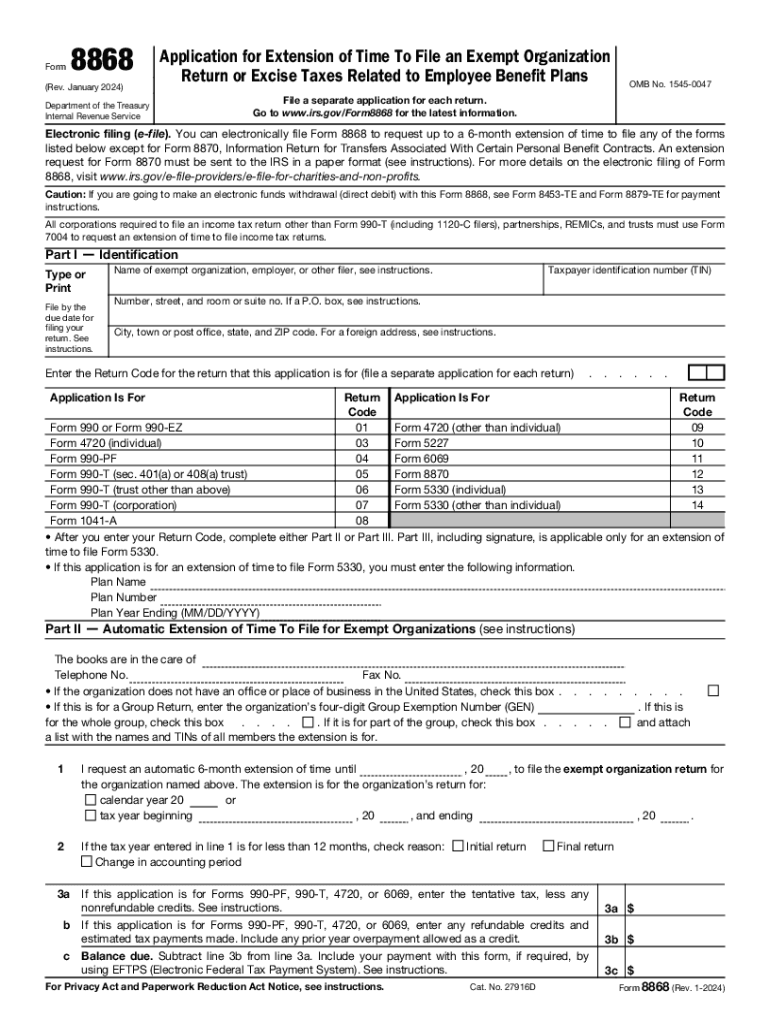

Form 8868

Application for Extension of Time To File an Exempt Organization Return

Form 8868 is used by an exempt organization to request an automatic 6-month extension of time to file its return. Also, the trustee of a trust required to file Form 1041-A or Form 5227 must use Form 8868 to request an extension of time to file those returns.

Available in:

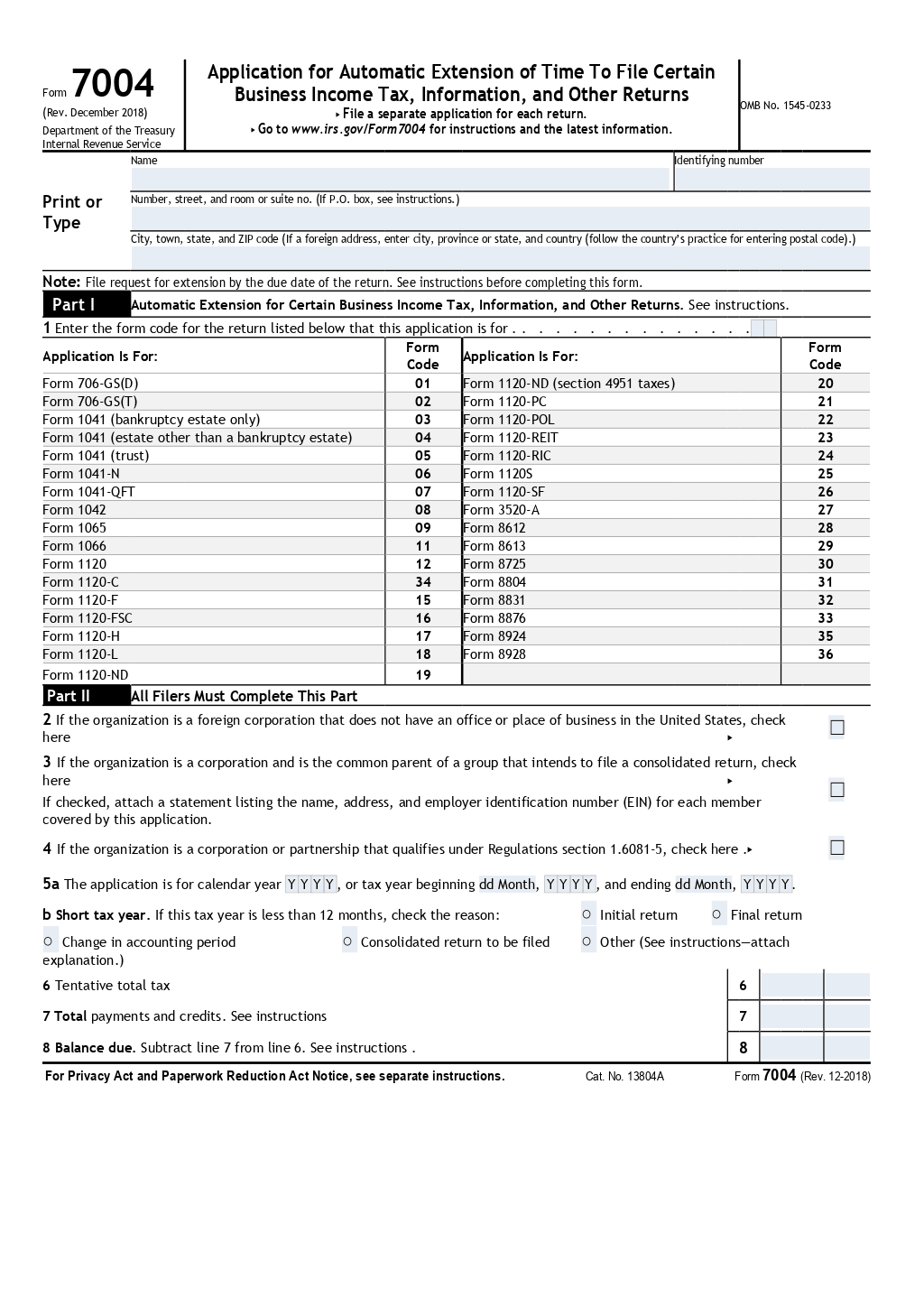

Form 7004

Application for Automatic Extension of Time To File Certain Business Income Tax, Information, and Other Returns

Use Form 7004 to request an automatic 6-month extension of time to file certain business income tax, information, and other returns.

Available in:

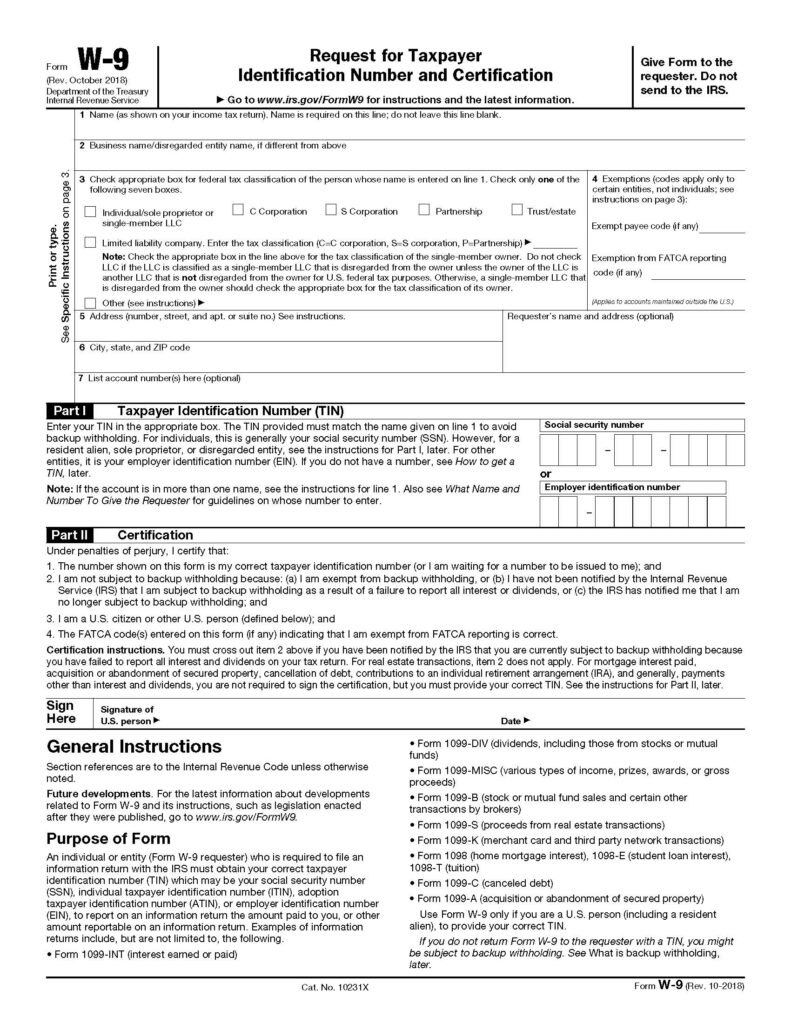

W-9 Form

Use Form W-9 to provide your correct Taxpayer Identification Number (TIN) to the person who is required to file an information return with the IRS to report, for example: Income paid to you. Real estate transactions. Mortgage interest you paid (calculate APR Mortgage Calculator).

Available in:

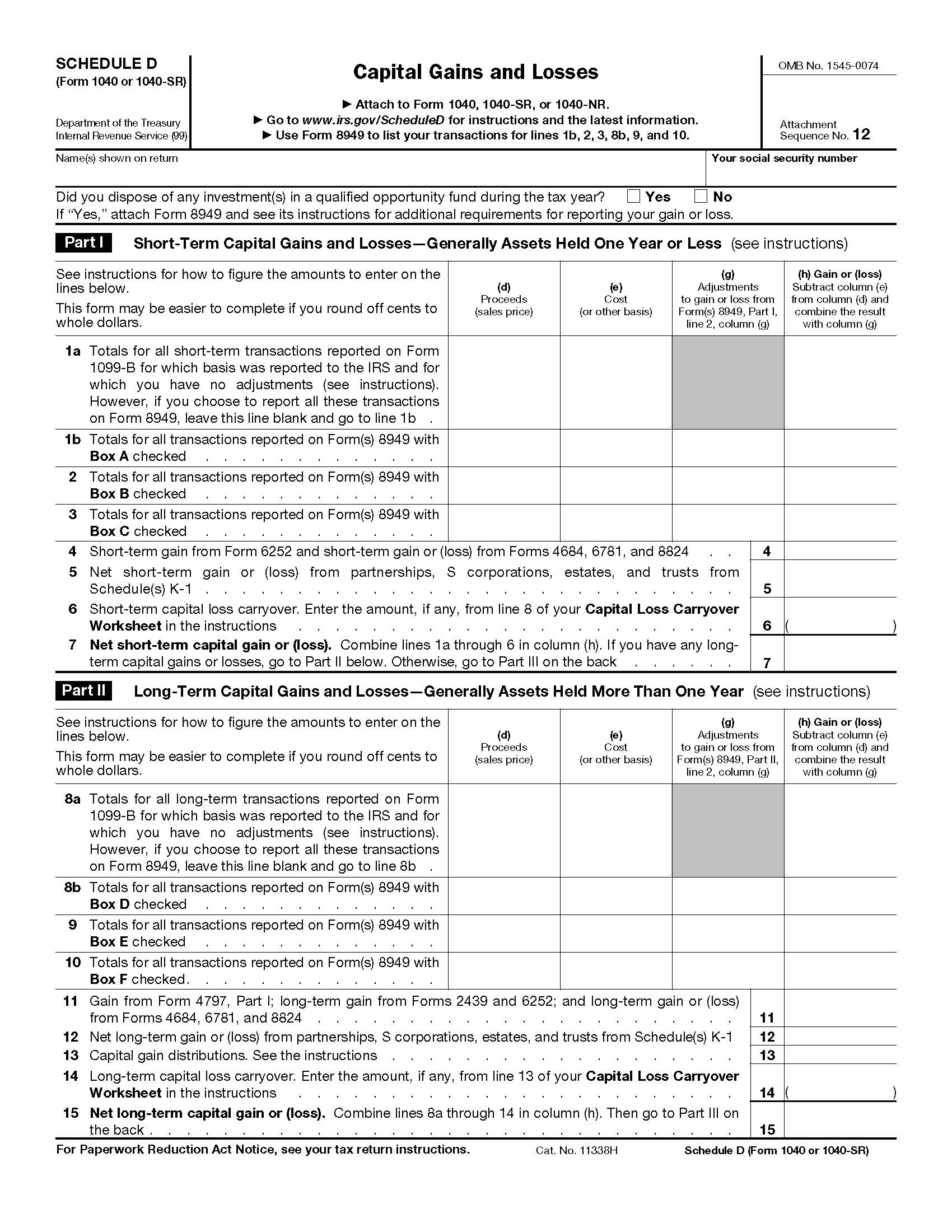

Schedule D Capital Gains and Losses

The Schedule D form is what most people use to report capital gains and losses that result from the sale or trade of certain property during the year.

Available in:

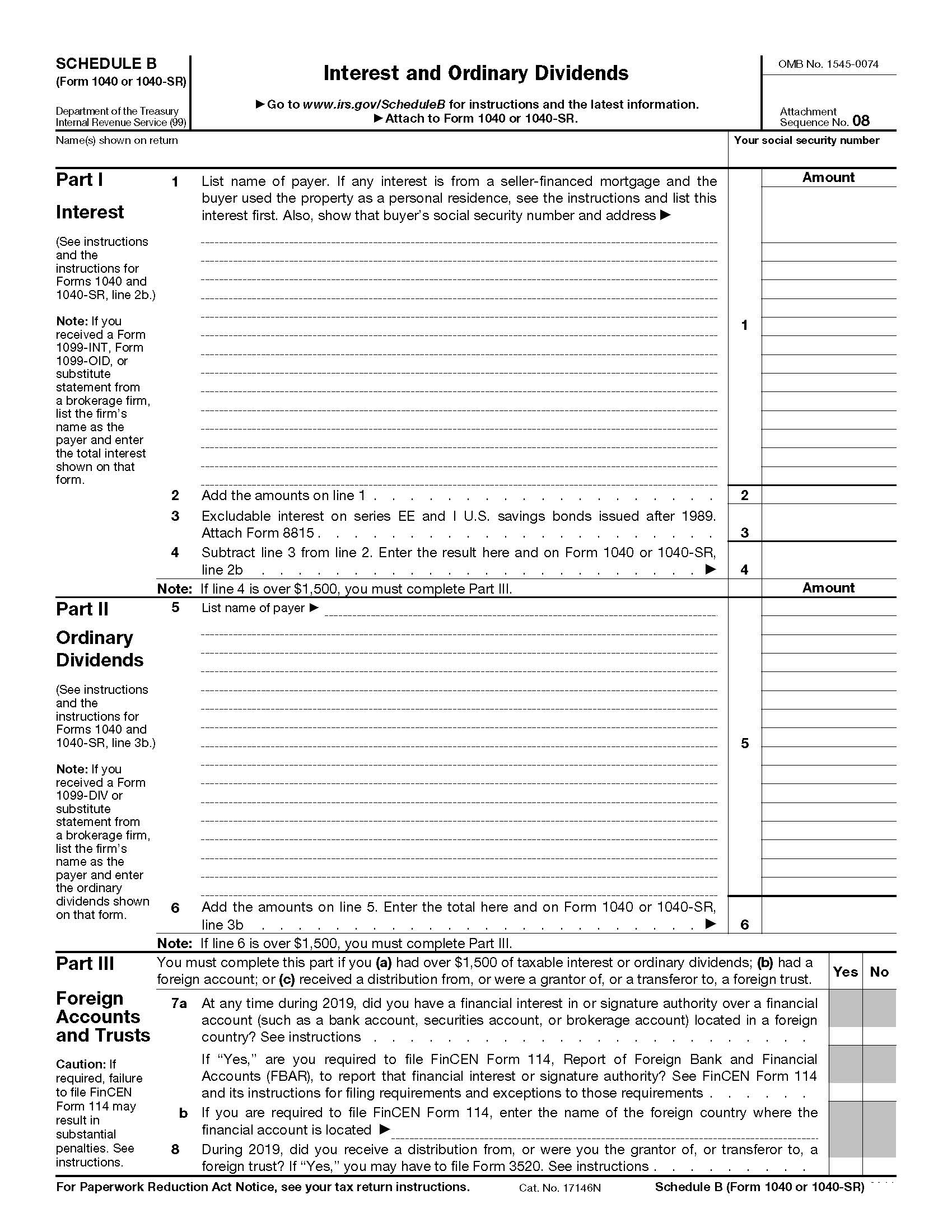

Schedule B Interest and Ordinary Dividends

Schedule B reports the interest and dividend income you receive during the tax year. However, you don’t need to attach a Schedule B every year.

Available in:

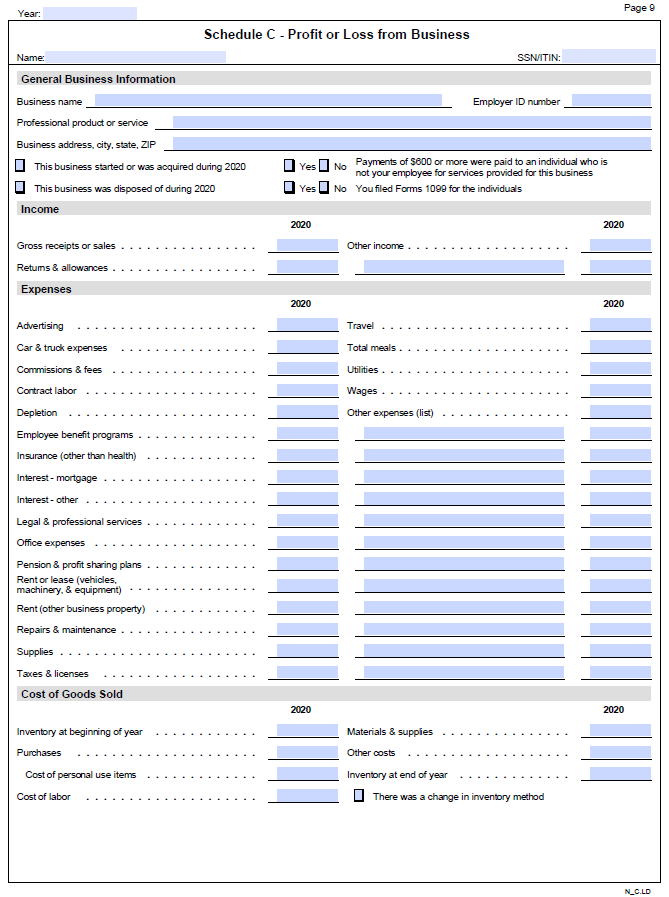

Schedule C Small Business Organizer

Use Schedule C (Form 1040) to report income or (loss) from a business you operated or a profession you practiced as a sole proprietor.

Available in: