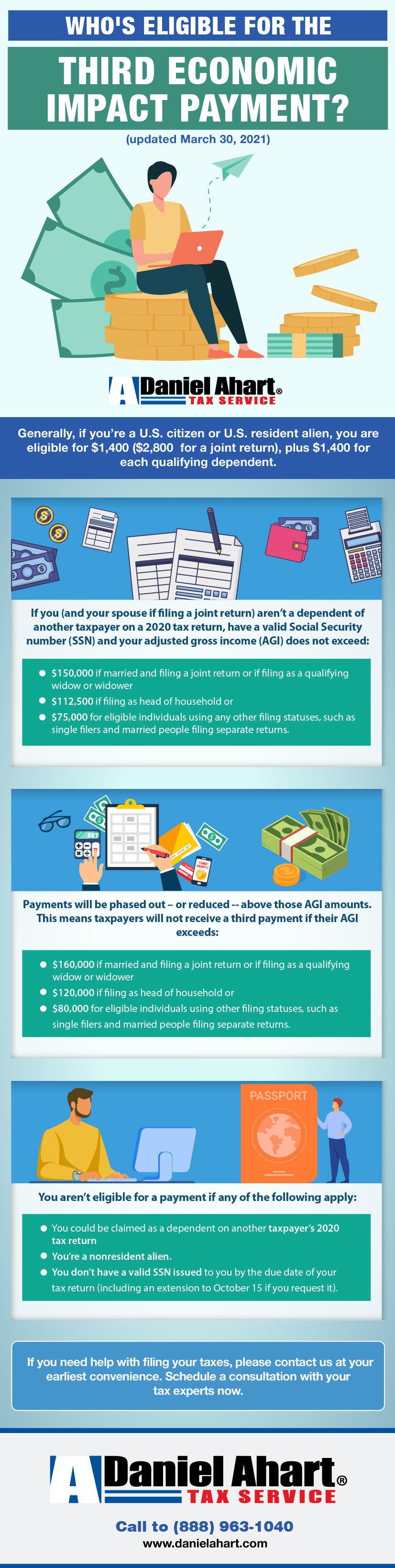

Generally, if you’re a U.S. citizen or U.S. resident alien, you are eligible for $1,400 ($2,800 for a joint return), plus $1,400 for each qualifying dependent, if you (and your spouse if filing a joint return) aren’t a dependent of another taxpayer on a 2020 tax return, have a valid Social Security number (SSN) (see exception when married filing jointly and exception for qualified dependents) and your adjusted gross income (AGI) does not exceed: