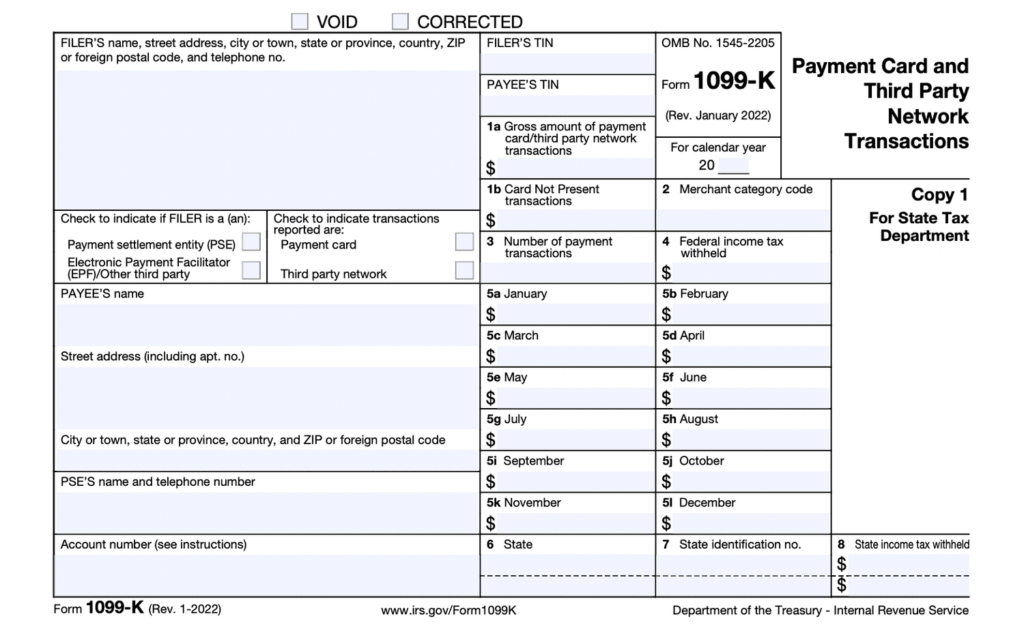

Yes, you may receive a Form 1099-K depending on the type of transactions.

According to the IRS, if you accept payment cards (for example, credit card or debit cards) as a form of payment for goods you sell or services you provide, you will receive a Form 1099-K for the gross amount of the payments made to you through the use of a payment card during the calendar year. This reporting requirement has not changed, and there is no minimum reporting threshold for these payments to trigger a reporting requirement.

Further, for calendar years after 2021, if you accept payments from a third party settlement organization, you may receive Form 1099-K from that organization. A third party settlement organization connects the parties together (for example, an internet sales site),” explains Daniel Ahart, chief tax officer at the tax preparation company Daniel Ahart Tax Service®

You will receive a Form 1099-K if you accepted payments from a third party settlement organization where,

- the total number of your transactions exceeded 200, and

- the aggregate amount of payments you received with respect to any participating payee exceeded $20,000 in the calendar year.

Read more: Form 1099-K Frequently Asked Questions: Individuals

Get The Help You Need When You Are Ready To File

Daniel Ahart Tax Service® prepares all tax returns, helps solve tax problems, and prepares back taxes. 22 Area Locations in Georgia.

Schedule An Appointment

Appointments are encouraged so that we are able to limit the number of people in our office. We ask that you come by yourself or with your spouse. Don’t bring extra people such as children.

Use our tool to find the office nearest you or click on a city link below. You will find office information and a link to schedule and manage your appointment on the office page.

Search For An Office

Select office for contact information or to schedule an appointment.