Blog

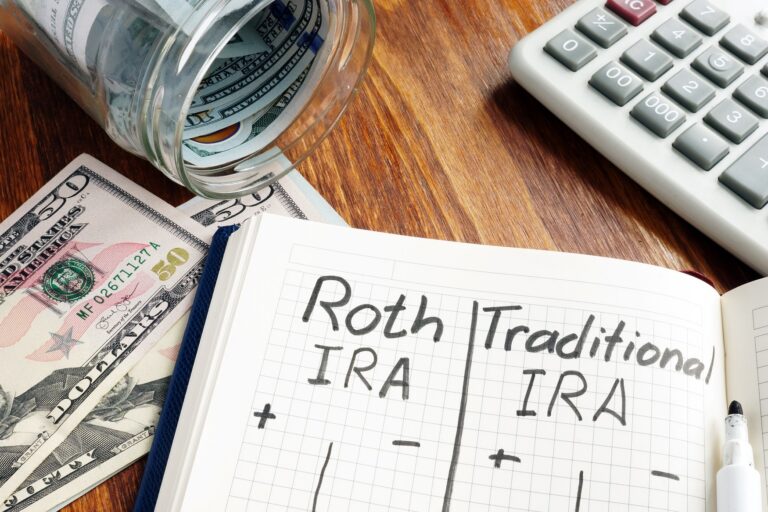

Each Retirement Account Has Its Own Unique Features And Tax Benefits

October 30, 2024 by Daniel Ahart Tax Service® 401(k) Plan: This is a type of employer-sponsored retirement plan where employees can contribute a portion of their salary on a pre-tax basis. Employers may also offer matching contributions. The contribution limit for 401(k) plans is $22,500 in 2023, with... Read more >

Fix Your Back Taxes And Settle

April 27, 2024 by Daniel Ahart Tax Service® How Daniel Ahart Tax Service Can Help You Fix Your Back Taxes and Settle Are back taxes weighing heavily on your mind? Dealing with tax debt can be stressful and overwhelming, but with the right guidance and expertise, you can... Read more >

How to Get a Tax ID or EIN for Your Business: A Step-by-Step Guide

April 25, 2024 by Daniel Ahart Tax Service® At Daniel Ahart Tax Service‘s expertise, personalized assistance, and commitment to compliance can greatly benefit businesses If you’re starting a new business or need to manage your taxes more efficiently, obtaining a Tax ID or Employer Identification Number (EIN) is... Read more >

⏰We Are Open the Whole Year For Personal and Business Taxes!

April 18, 2024 by Daniel Ahart Tax Service® At Daniel Ahart Tax Service, we position you to minimize today’s tax impact and mitigate future tax impacts. At Daniel Ahart Tax Service, we help you with your personal and business tax needs all year round, whether you need to... Read more >

Filing a Tax Extension with Daniel Ahart Tax Service® before the April 15 deadline

April 3, 2024 by Daniel Ahart Tax Service® Even if you File an Extension, You Must Still Pay Your Income Tax in Full by the Tax Deadline Need more time to prepare your federal tax return? Traditionally, federal tax returns are due on April 15 or the first... Read more >What to Do if I Receive a Letter from the IRS?

April 1, 2024 by Daniel Ahart Tax Service® What taxpayers should do if they get a letter or notice from the IRS Your notice or letter will explain the reason for the contact and give you instructions on how to handle the issue. If you agree with the... Read more >

Taxable Events from your Crypto Investing Activity

March 25, 2024 by Daniel Ahart Tax Service® Crypto Taxes: Tax Reporting Requirements Virtual currency is a digital representation of value that functions as a medium of exchange, a unit of account, and/or a store of value. In general, the sale or exchange of convertible virtual currency,... Read more >

Self-Employment Tax Deductions Explained

February 21, 2024 by Daniel Ahart Tax Service® Tax Season 2024 (for filing year 2023 taxes): Tax Benefits for the Self-Employed Being self-employed comes with its own set of financial responsibilities, but it also offers opportunities for tax deductions and credits that can help reduce the overall tax... Read more >

We Have 22 Locations To Better Serve You In the State of Georgia

February 16, 2024 by Daniel Ahart Tax Service® Whether you live in Alpharetta, Cartersville or Riverdale, there’s a Daniel Ahart Tax Service office near you It’s important to remind our existing and prospective clients that we are open all year round so that we are ready to assist... Read more >

$6000 Tax Advances Available Now: Are They Worth It?

January 25, 2024 by Daniel Ahart Tax Service® You can get tax refund advances of up to $6,000 but isn’t the best fit for each particular situation From January through April, a tax refund loan can be a great way to get money quickly. But you need to... Read more >

Tax Benefits for Employer-Provided Child Care in Georgia

September 4, 2023 by Daniel Ahart Tax Service® The Georgia credit can offset up to 50% of the taxpayer’s income tax liability for the year In addition, any excess amounts can be carried forward up to five years. Qualifying expenditures include the cost of acquiring and operating an... Read more >- « Previous Page

- 1

- 2

- 3

- 4

- …

- 7

- Next Page »