Blog

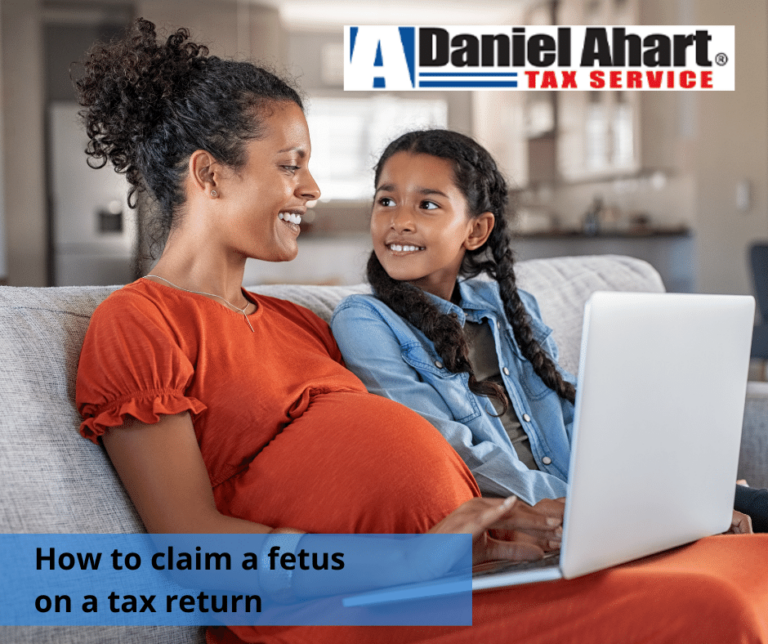

If I Have A Holiday Craft Business, Will I Receive A Form 1099-K?

January 17, 2023 by Daniel Ahart Tax Service® You will receive a Form 1099-K if you accepted payments from a third party settlement organization where, the total number of your transactions exceeded 200, and the aggregate amount of payments you received with respect to any participating payee exceeded... Read more >

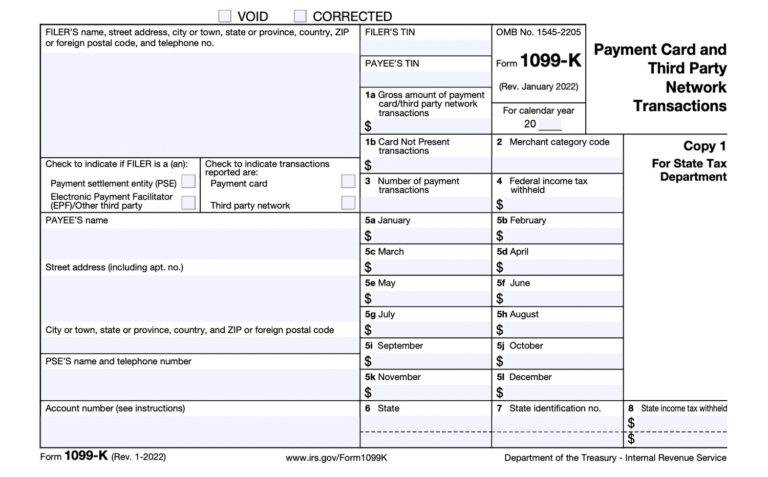

How to Handle a 1099-K for Personal Payments

December 21, 2022 by Daniel Ahart Tax Service® Venmo and PayPal Tax Reporting Change Many Americans are bracing for a new reporting change for third-party payment networks like Venmo or PayPal. Starting in 2022, you’ll receive Form 1099-K, which reports income to the IRS, for business transfers over $600.... Read more >

Steps You Can Take Now to Make Tax Filing Easier In 2023

December 1, 2022 by Daniel Ahart Tax Service® Planning ahead can help people file an accurate return and avoid processing delays that can slow tax refunds. As wrote in a previous blog “What About a Tax Checkup?,” this is also definitely a good time for filers to prepare... Read more >

You Can File Your Tax Return Any Time Before the Extension Expires On October 17, 2022

September 29, 2022 by Daniel Ahart Tax Service® Don’t Miss Your Tax Deadline If You Requested An Automatic Extension Earlier This Year You needed more time to prepare your federal tax return? Fine, now it’s the time to file, as long as you requested before April 18, 2022... Read more >

$500 Property Tax Break Proposed by Kemp

September 22, 2022 by Daniel Ahart Tax Service® The property tax break is already part of Georgia law, but inactive – A handout from the governor’s office noted it was established in 1999 under O.C.G.A 36-89-3 and 36-89-4. Basically, it gives the state legislature the option to provide... Read more >

Home Financing Calculators

September 15, 2022 by Daniel Ahart Tax Service® 15 Year vs. 30 Year Mortgage Calculator – Use this calculator to compare these two mortgage terms, and decide which term is better for you. Adjustable Rate Mortgage Calculator – This calculator helps you to determine what your adjustable mortgage... Read more >

Tax Estimators Calculators

September 13, 2022 by Daniel Ahart Tax Service® 1040 Tax Calculator – Enter your filing status, income, deductions and credits and we will estimate your total taxes. Based on your projected tax withholding for the year, we can also estimate your tax refund or amount you may owe... Read more >

Business Finance Calculators

September 10, 2022 by Daniel Ahart Tax Service® Asset Allocator Calculator – Your age, ability to tolerate risk, and several other factors are used to calculate a desirable mix of stocks, bonds and cash. Break Even Analysis Calculator – Find out how many and what price you must... Read more >

What Is The “Fetal Personhood” Provision? $3,000 Tax Exemption Starting At Around Six Weeks Of Pregnancy

August 11, 2022 by Daniel Ahart Tax Service® Georgia residents can now claim a fetus as a dependent on their tax returns for a $3,000 exemption. Once the Supreme Court reversed Roe in June 2022, many expected the courts to revisit Georgia’s law. That effectively happened in July... Read more >

IRS To Add 87,000 New Agents? Common IRS Audit Triggers

August 11, 2022 by Daniel Ahart Tax Service® What should taxpayers do if they get an audit from the IRS? Reports suggest that the Internal Revenue Service intends to use nearly $80 billion in new funding from The Inflation Reduction Act of 2022, to pursue toward the hiring... Read more >