Blog

New $3,000 Child Tax Credit to Start Payments in July, 2021

April 30, 2021 by Daniel Ahart Tax Service® The $1.9 trillion aid package that President Joe Biden signed into law in March temporarily expands the child tax credit. For the 2021 tax year, the credit is upped to $3,000 per child age 17 or younger and $3,600 for... Read more >

Third Stimulus Checks: $1,400 Payments Update

April 28, 2021 by Daniel Ahart Tax Service® Here’s the latest timeline on when you might see the money and what to do if you haven’t received it yet. The IRS has started processing and sending out stimulus checks for millions of Americans after President Joe Biden signed... Read more >

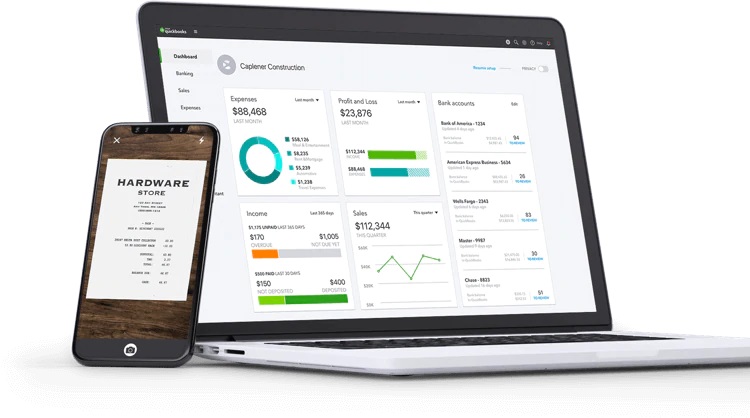

How Do I Set Up Daniel Ahart Tax Service® As Accountant in My QuickBooks Online?

April 23, 2021 by Daniel Ahart Tax Service® QuickBooks Online allows you to invite different users through the Manage Users page. If you’d like to give us, Daniel Ahart Tax Service®, access to your company, see the steps below. Sign in to QuickBooks Online (QBO). Select the Settings... Read more >

Will I Owe the IRS Tax on My Stimulus Payment?

April 23, 2021 by Daniel Ahart Tax Service® The stimulus payment is technically a tax credit The economic impact payment, as the IRS calls it — reduces your income, which reduces the amount of tax you owe. To illustrate this, if you had $50,000 in income and had... Read more >

Why You Shouldn’t Wait to File your Taxes on May 17?

April 23, 2021 by Daniel Ahart Tax Service® If you’re in line for a stimulus payment, here’s why you shouldn’t wait to file your taxes on May 17: As we informed our readers in a previous blog, the IRS announced in March that it was extending the tax... Read more >

How Are Taxes Calculated for Crypto?

April 21, 2021 by Daniel Ahart Tax Service® You can calculate the capital gains/losses on your crypto transactions with the use of a simple formula: Fair Market Value (FMV) – Cost Basis = Capital gain or loss Where: FMV = the price that an asset, such as cryptocurrency,... Read more >

Tax Day for Individuals Extended to May 17

April 6, 2021 by Daniel Ahart Tax Service® For the second year in a row, you have additional time to file your federal taxes. The Treasury Department and Internal Revenue Service announced on March 17, 2021 that the federal income tax filing due date for individuals for the... Read more >

The Basics of Crypto Taxes: What is Virtual Currency?

March 20, 2021 by Daniel Ahart Tax Service® Virtual currency is a medium of exchange that operates like a currency in some environments, but does not have all the attributes of real currency. In particular, virtual currency does not have legal tender status in any jurisdiction. Virtual currency... Read more >- « Previous Page

- 1

- …

- 5

- 6

- 7