Tax essentials for crypto investors

While tax regulations can indeed vary by jurisdiction when it comes to cryptocurrencies, here are some general considerations for crypto taxation:

- Cryptocurrency Classification: Different tax authorities may classify cryptocurrencies differently. Some may treat them as property, while others view them as a form of currency or investment. Understanding how your jurisdiction classifies cryptocurrencies is important for tax purposes.

- Taxable Events: Taxable events occur when you realize a gain or loss on your cryptocurrency investments. Common taxable events include selling or exchanging cryptocurrencies for fiat currency (e.g., USD) or other cryptocurrencies, using cryptocurrencies to purchase goods or services, and receiving cryptocurrency as income.

- Capital Gains and Losses: When you sell or exchange cryptocurrencies, you may generate capital gains or losses. Capital gains are typically taxable, while capital losses can potentially offset capital gains, reducing your overall tax liability. Short-term capital gains (held for one year or less) are usually taxed at ordinary income rates, while long-term capital gains (held for more than one year) may be subject to lower tax rates.

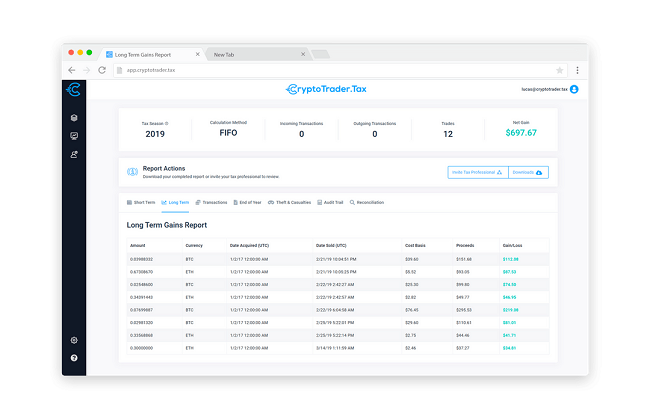

- Reporting Requirements: Depending on your jurisdiction, you may have reporting requirements for your cryptocurrency transactions. This can include reporting gains and losses on your tax return, providing details about your cryptocurrency holdings, and potentially filing additional forms specific to cryptocurrency, such as the IRS Form 8949 in the United States.

- Cost Basis and Tracking: Calculating the cost basis of your cryptocurrency holdings is crucial for determining your gains or losses when you sell or exchange them. Tracking your transactions and keeping detailed records of purchase prices, dates, and any associated fees or expenses is essential for accurate tax reporting.

- Crypto-to-Crypto Transactions: Exchanging one cryptocurrency for another is generally considered a taxable event. The fair market value of the cryptocurrency at the time of the exchange is used to determine the gains or losses. It’s important to keep records of these transactions and report them accordingly.

- Airdrops, Forks, and Staking Rewards: Other events, such as receiving airdrops (free distribution of cryptocurrencies), participating in forks (when a blockchain splits into two separate chains), or earning staking rewards, can have tax implications. These events may be considered taxable income, and their fair market value at the time of receipt should be reported.

- Deductible Expenses: If you are actively involved in cryptocurrency mining or trading as a business, you may be able to deduct certain expenses related to your activities. These can include equipment costs, electricity bills, transaction fees, and other relevant expenses. Consult a tax professional to determine which expenses are deductible in your jurisdiction.

Read also: “Crypto Taxes: Do I Need To Report My Gains And Losses?“

Given the evolving nature of cryptocurrencies and the complexities of tax regulations, it is crucial for individuals and businesses involved in cryptocurrencies to understand the specific tax rules and obligations in their jurisdiction.

It’s important to note that cryptocurrency taxation is a complex and evolving area. Tax regulations can change, and specific rules may vary by jurisdiction. Contact us to learn how crypto taxes relates to your specific situation,” suggests Daniel Ahart, chief tax officer at the tax preparation company Daniel Ahart Tax Service®

Taking Care of your Crypto Taxes

Also, remember that if you have any crypto tax obligations for the 2022 tax year, you need to report it. Join the thousands of individuals in the State of Georgia that trust their taxes to Daniel Ahart each year!

Schedule An Appointment

Appointments are encouraged so that we are able to limit the number of people in our office. We ask that you come by yourself or with your spouse. Don’t bring extra people such as children.

Use our tool to find the office nearest you or click on a city link below. You will find office information and a link to schedule and manage your appointment on the office page.