Maximize Your Tax Refund with One of the Most Valuable Credits Available

When it comes to lowering your tax bill and possibly boosting your refund, the Earned Income Tax Credit (EITC) is one of the most powerful tools available to working individuals and families with low to moderate income. Yet, many taxpayers miss out on this credit simply because they don’t realize they qualify. In this post, we’ll break down what the EITC is, who qualifies, and how to claim it properly.

What is the Earned Income Tax Credit (EITC)?

The Earned Income Tax Credit is a refundable tax credit designed to help low- to moderate-income workers and families reduce their tax liability. A refundable credit means that even if you don’t owe any taxes, you may still receive money back in the form of a refund.

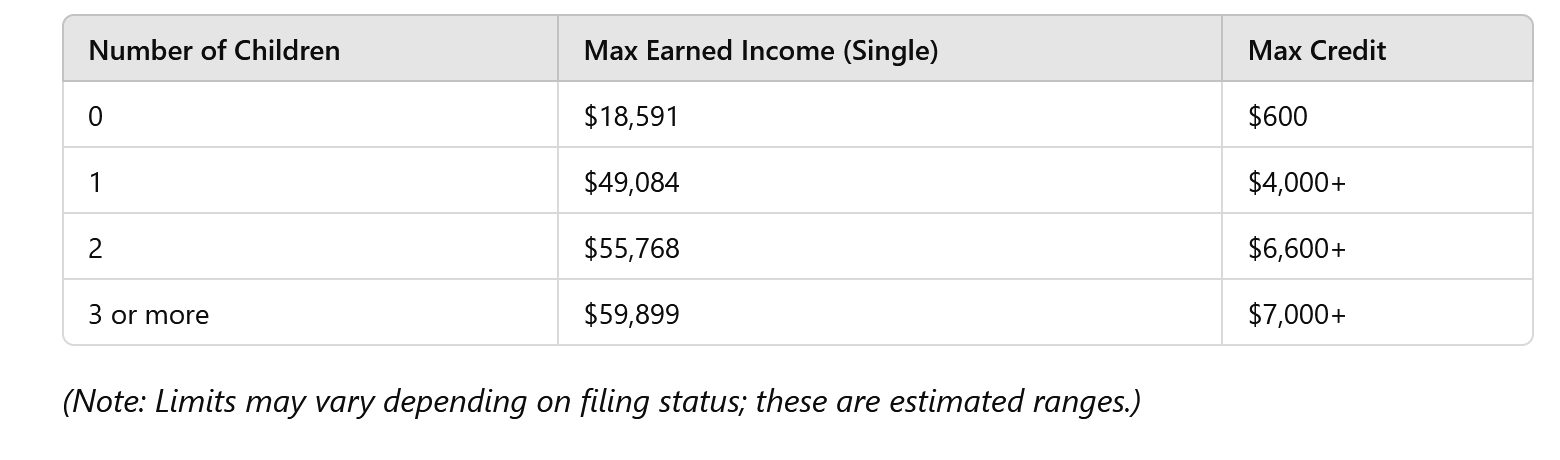

The EITC amount depends on your income, filing status, and number of qualifying children. For tax year 2024 (filed in 2025), the credit ranges from $600 to over $7,000.

It’s important to note that tax credits are generally more valuable than tax deductions, but not everyone will qualify for all tax credits or deductions,” shared Daniel Ahart, chief tax officer at the tax preparation company Daniel Ahart Tax Service®.

Who Qualifies for the EITC?

To qualify for the EITC, you must meet specific income and filing requirements, and have earned income through employment or self-employment. Here’s a basic checklist:

✅ Basic Requirements:

- You must have earned income from a job or self-employment.

- You must have a valid Social Security number.

- You must be a U.S. citizen or resident alien for the entire tax year.

- Your filing status must be Single, Married Filing Jointly, Head of Household, or Qualifying Widow(er) (you cannot file as “Married Filing Separately”).

- Investment income must be $11,600 or less for the tax year 2024.

✅ Qualifying Children:

- If you have children, they must meet the IRS definition of a “qualifying child”—based on age, relationship, residency, and joint return rules.

- You can still qualify without children, but the credit amount is lower and you must be between the ages of 25 and 65.

2024 Earned Income and Credit Limits (For Reference)

How to Claim the EITC

Claiming the EITC is easy when you file your federal tax return, but accuracy is essential to avoid processing delays.

Here’s how to do it:

- Use tax software that checks for EITC eligibility automatically.

- Hire a trusted tax professional like Daniel Ahart Tax Service to ensure all requirements are met.

- File IRS Form 1040 and fill out the EIC Schedule if required.

If you qualify, the IRS will add the credit to your refund, even if you owe little or no income tax.

Why You Shouldn’t Miss the EITC

Each year, millions of dollars go unclaimed because eligible taxpayers don’t file or claim the EITC. Don’t leave money on the table! Whether you’re a single filer with no children or a family with multiple dependents, you could be eligible for thousands of dollars in credit.

Let Us Help You Claim What You Deserve

At Daniel Ahart Tax Service, we specialize in helping individuals and families maximize their refund and take advantage of every credit they deserve. If you’re unsure whether you qualify for the EITC or need help filing, our experienced team is here to guide you every step of the way.

👉 Contact us today to schedule your tax consultation.

Remember that every person and every tax return is different, this is just a guide, please find the closest DATS location near you and do not hesitate to contact us. Daniel Ahart Tax Service will be open and ready to answer the phone or in person to clarify any doubts and to be able to guide you in the process,” explains Daniel Ahart, chief tax officer at the tax preparation company Daniel Ahart Tax Service®

Taking Care of your Crypto Taxes

Also, remember that if you have any crypto tax obligations for the 2024 tax year, you need to report it. Join the thousands of individuals in the State of Georgia that trust their taxes to Daniel Ahart each year!

Schedule An Appointment

Appointments are encouraged so that we are able to limit the number of people in our office. We ask that you come by yourself or with your spouse. Don’t bring extra people such as children.

Use our tool to find the office nearest you or click on a city link below. You will find office information and a link to schedule and manage your appointment on the office page.