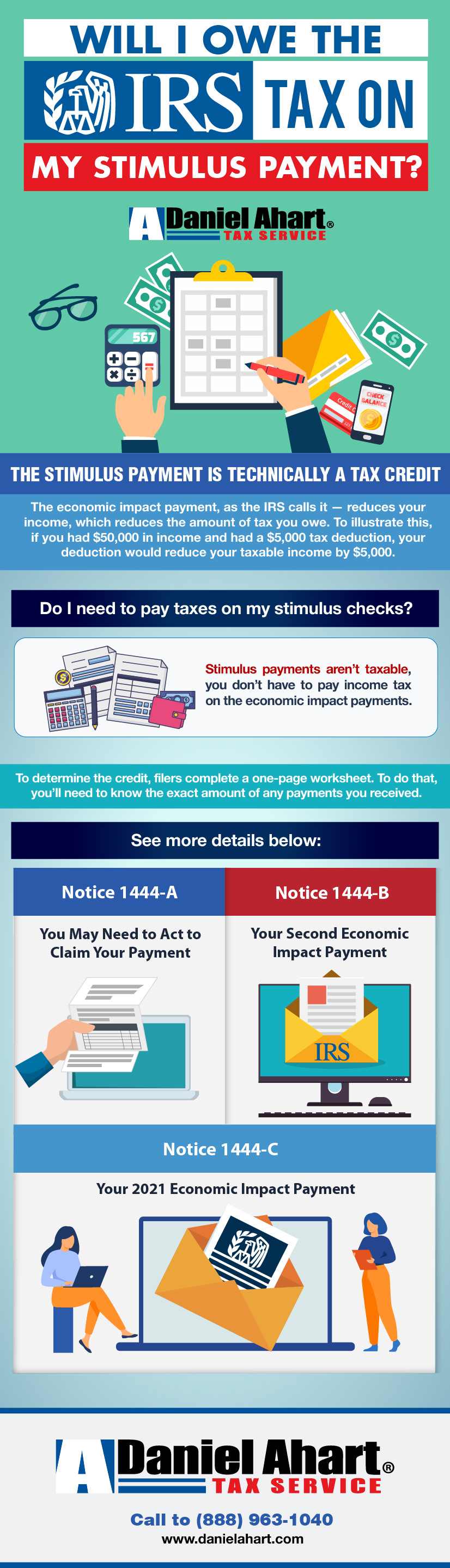

You don’t have to pay income tax on the economic impact payments.

That’s right, the stimulus payment is technically a tax credit. However, they could indirectly affect what you pay in state income taxes in a handful of states, where federal tax is deductible against state taxable income.

You don’t need to report the payments on your taxes.

Also important to note is that you don’t need to include information about the payments on your 2020 tax return, the Internal Revenue Service says.