Schedule Tax Forms

Information about Schedule Tax Forms (Schedules A B, C, D, E), including recent updates, related forms, and instructions on how to file your taxes.

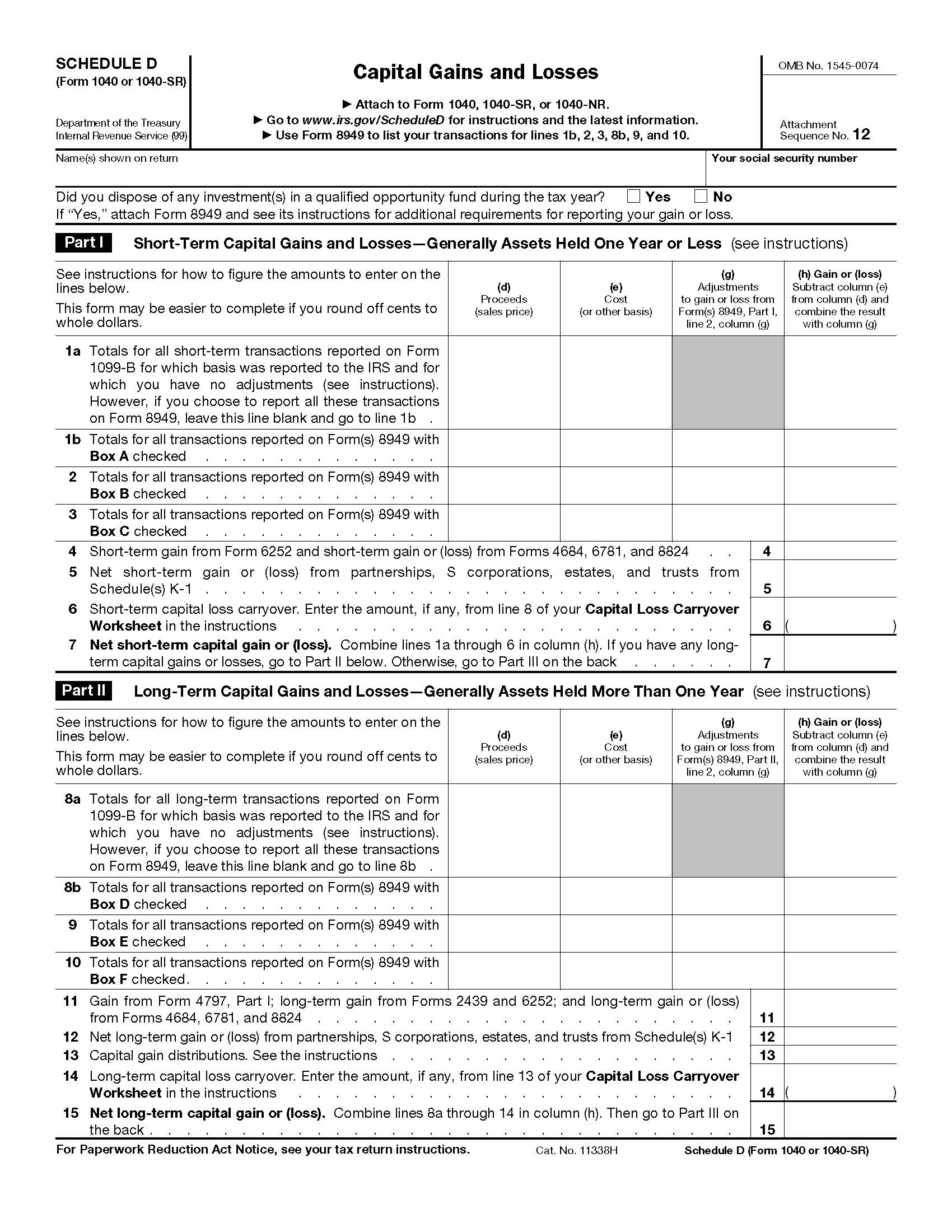

Schedule D Capital Gains and Losses

The Schedule D form is what most people use to report capital gains and losses that result from the sale or trade of certain property during the year.

Available in:

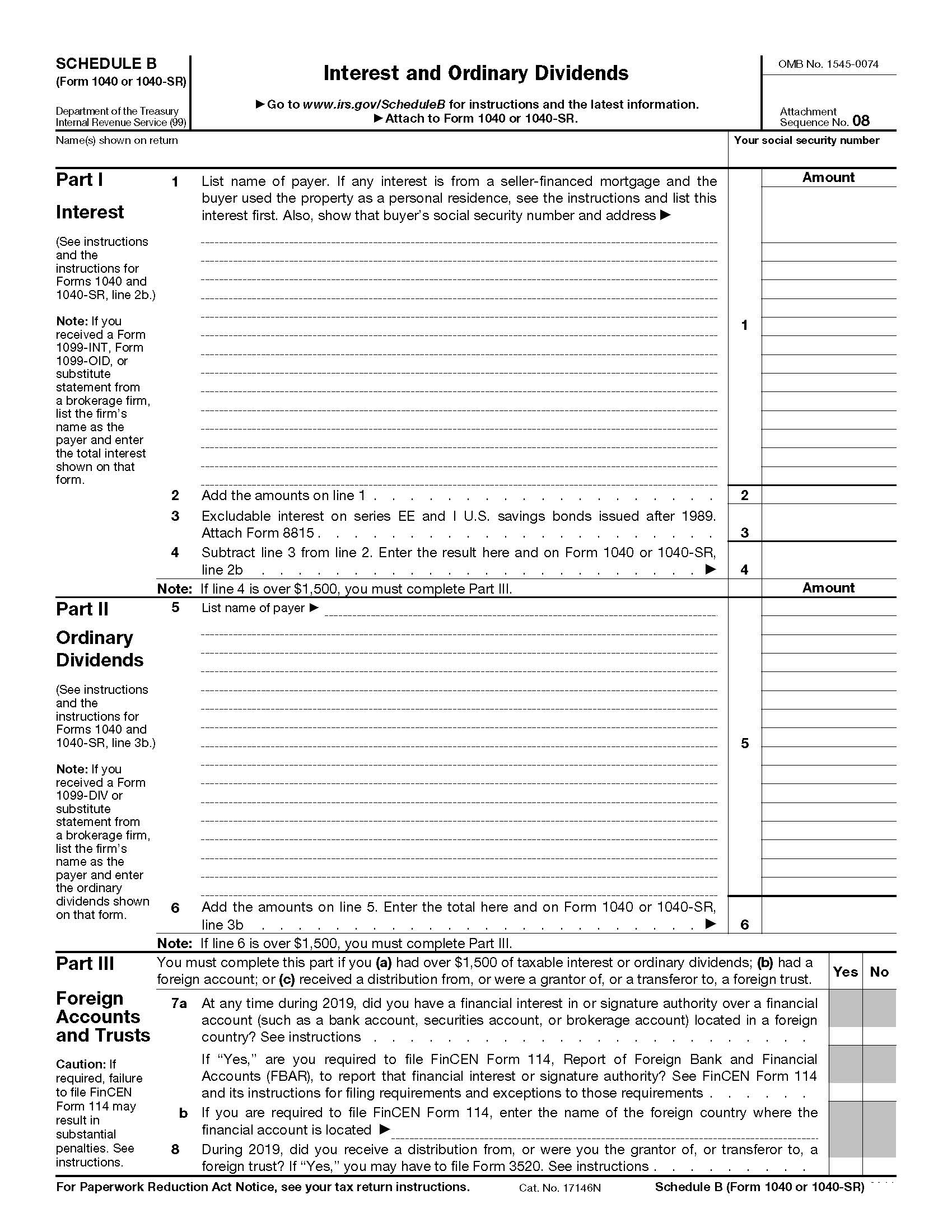

Schedule B Interest and Ordinary Dividends

Schedule B reports the interest and dividend income you receive during the tax year. However, you don’t need to attach a Schedule B every year.

Available in:

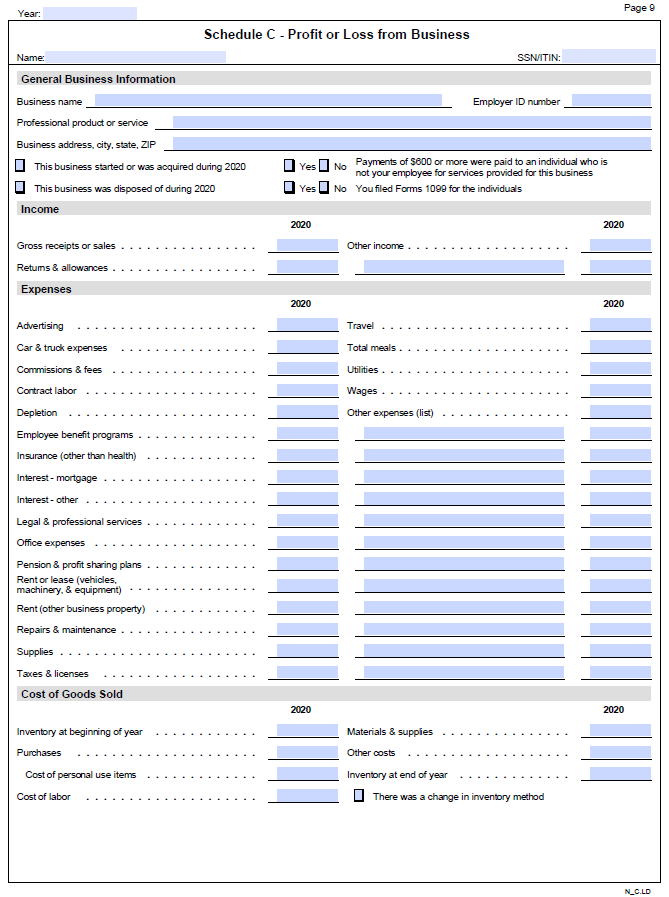

Schedule C Small Business Organizer

Use Schedule C (Form 1040) to report income or (loss) from a business you operated or a profession you practiced as a sole proprietor.

Available in:

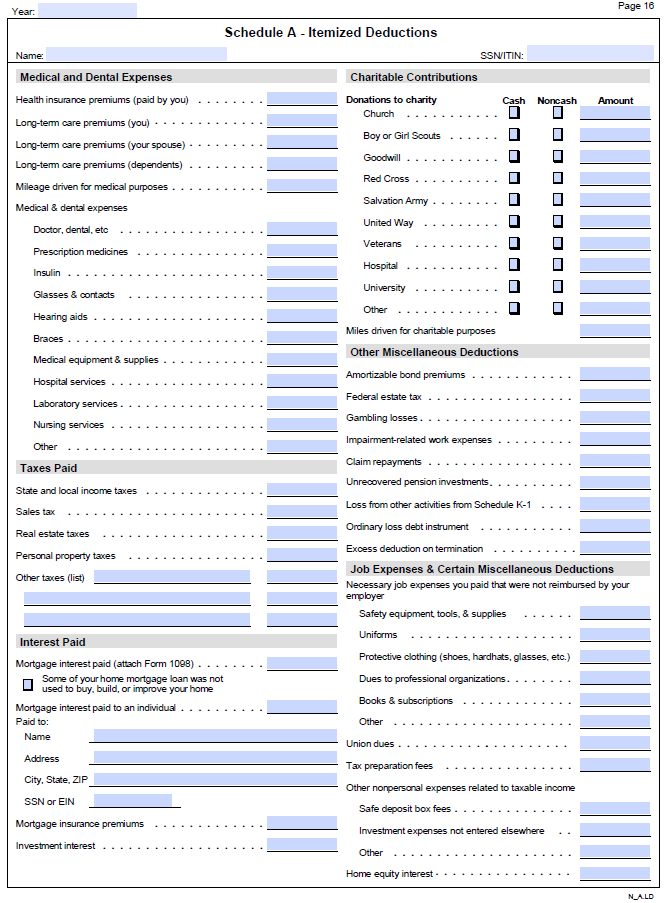

Schedule A Itemized Deductions

Use Schedule A (Form 1040 or 1040-SR) to figure your itemized deductions. In most cases, your federal income tax will be less if you take the larger of your itemized deductions or your standard deduction.

Available in:

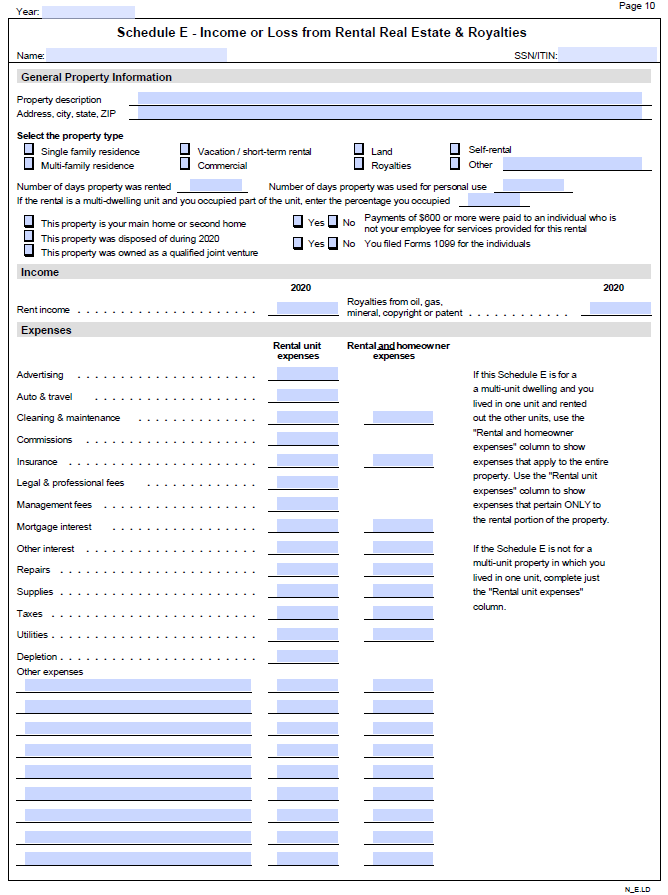

Schedule E Rental Property

Schedule E is part of IRS Form 1040. It is used to report income or loss from rentals, royalties, S corps, partnerships, estates, trusts, and residential interest in REMICs (real estate mortgage investment conduits).

Available in: