File your Small Business Forms With Us!

Tax Preparation for Small Business Owners

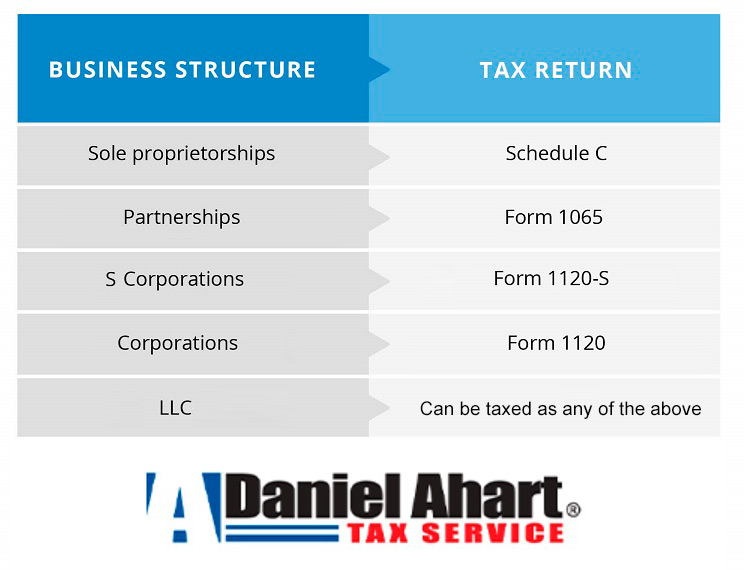

There are various ways you can file your company taxes, depending on whether you run the business as a sole proprietorship or use a legal entity such as a Limited liability company (LLC) or Corporation.

In each case, you need to report your business income and expenses. Regardless of the form you use, you generally calculate your taxable business income in similar ways.

We can help you with your business taxes. Please find below some tips before getting started with the process.

Get all your business records

Before filling out any tax form to report your business income, you should have all records in front of you that report your business earnings and expenses.

If you use a computer program or a spreadsheet to organize and keep track of all transactions during the year, calculating your income and deductions is much easier than trying to remember every sale and expenditure that occurred during the year.

Let us help you to determine the correct IRS tax form

You always need to report your business earnings to the IRS and pay tax on them, but choosing the right form to report earnings on depends on how you operate your business.

Many small business owners use a sole proprietorship which allows them to report all of their business income and expenses on a Schedule C attachment to their personal income tax return. If you run the business as an LLC and you are the sole owner, the IRS also allows you to use the Schedule C attachment. However, if you use a corporation or elect to treat your LLC as one, then you must always prepare a separate corporate tax return on Form 1120 (or Form 1120S if you are an S-Corp).

Fill out the right business form

Schedule C is a simple way for filing business taxes since it is only two pages long and lists all the expenses you can claim. When complete, you just subtract your expenses from your business earnings to arrive at your net profit or loss. Remember you have to transfer this number to your personal income tax form and include it with all other personal income tax items.

If you use a Form 1120, you calculate your taxable business income in the same way, but the form requires more details that may not always apply to a small business. The disadvantage of filing a Form 1120 is that it is separate from your personal income tax return.

Be aware of different filing deadlines:

Schedule C, it is part of your Form 1040, it’s subject to the April 15 deadline.